In the school business office, budgeting is never really “done.”

Once the annual budget is approved, it immediately turns into a working document, tested daily by staffing changes, program requests, facilities maintenance, enrollment shifts, and the inevitable unexpected expense. For school business officers, budgeting is not about locking numbers in place. It is about managing uncertainty while keeping the school financially stable and mission focused.

That reality is why budget management in schools is fundamentally different from budgeting in other industries. Schools operate across multiple funds, departments, and restrictions, all while balancing educational priorities with fiscal responsibility. And yet, many schools continue to rely on systems that were never designed for the complexity of school accounting or the evolving demands placed on school accounting software.

Over years of working with schools of varied sizes and governance models, one pattern appears repeatedly: budgeting challenges rarely come from a lack of discipline, effort, or expertise. They come from systems that do not support how schools operate.

In many schools, budgeting still lives in spreadsheets layered on top of accounting systems that were never built for active budget management.

When Budget Management Becomes Operationally Inefficient

Budgets are spread across multiple files. Revisions arrive through email. Department heads maintain their own versions. Finance teams spend hours reconciling numbers just to answer a basic question: Where do we stand right now?

The issue is not inaccurate budgeting — it is delayed insight. By the time finance teams feel confident in the numbers, circumstances have already changed. Over time, this creates a reactive budgeting culture, not because teams lack foresight, but because their tools make timely visibility difficult.

This is often the moment when schools begin evaluating school accounting software — not to replace financial expertise, but to reduce friction, manual effort, and uncertainty in the budgeting process.

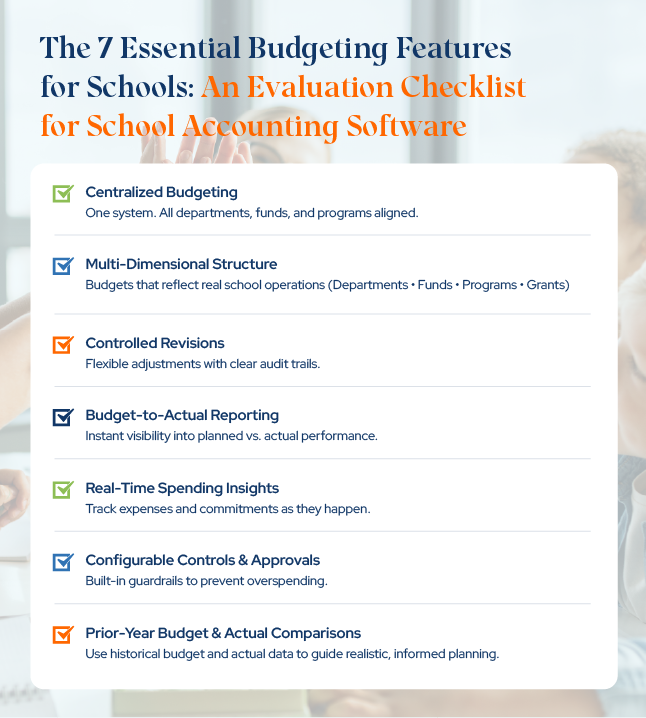

Below are seven essential features K-12 schools should consider when selecting the right accounting software to support effective budgeting.

1. Establishing a Centralized View of the School Budget

The most impactful improvement schools can make to budgeting is centralization.

Effective school accounting software allows business officers to build, manage, and review budgets across departments, funds, and programs in one system. Instead of reconciling multiple versions, everyone works from the same, current data.

This single source of truth reduces version-control issues and eliminates confusion during mid-year reviews. It also shortens the time between “What’s happening?” and “What should we do next?”

Practical insight:

When evaluating systems, ask how many “sources of truth” exist for budget data. If the answer is more than one, budgeting will always involve reconciliation instead of analysis.

Centralization does not simplify the financial reality of a school, but it makes that reality visible. And visibility is the foundation for better decision-making.

2. Structuring Budgets to Reflect How Schools Use Money

Schools do not operate from a single pool of unrestricted funds.

Tuition revenue, grants, restricted donations, departmental allocations, and program-specific expenses all follow different rules. Yet many systems force these into flat budget structures that obscure ownership, accountability, and compliance.

Purpose-built school accounting software supports multi-dimensional budgeting, allowing budgets to be structured by:

- Accounts

- Funds

- Departments or cost centers

This structure mirrors real-world operations and supports clearer oversight across the institution.

Practical insight:

A strong budget structure should quickly answer: Who owns this budget, what rules apply, and how does it connect to the general ledger?

When budgets reflect operational reality, reviews become more meaningful and compliance becomes easier to maintain.

3. Maintaining Budget Flexibility Without Losing Control

No school finishes the year exactly as planned.

Enrollment fluctuates. Staffing needs to evolve. New initiatives emerge. Facilities issues demand immediate attention. The issue isn’t change — it is how easily the budget can respond to it.

Flexible budgeting tools allow finance teams to adjust allocations without rebuilding budgets from scratch or losing historical context. This is especially critical in multi-fund environments, where changes in one area can affect others.

Practical insight:

Look for systems that support controlled revisions, where changes are tracked, approved, and visible rather than overwritten.

Flexibility should strengthen governance, not weaken it.

4. Monitoring Financial Performance Through Budget-to-Actual Analysis

Building a budget is only the beginning. Managing it requires continuous comparison between planned and actual performance.

Budget-to-actual tracking allows finance teams to identify variances early, understand spending patterns, and adjust forecasts before small issues become major problems.

Schools that review budget performance regularly — not just at month-end or quarter-end are better positioned to make informed decisions throughout the year.

Practical insight:

Budget-to-actual reports should be accessible to both finance teams and department leaders. Clear, interpretable reports encourage ownership and accountability.

When variance analysis becomes routine, budgeting shifts from compliance to stewardship.

5. Enabling Timely Decisions Through Real-Time Visibility

Traditional reporting cycles often delay insight until it is least useful.

Modern school accounting software provides real-time visibility into spending, commitments, and remaining balances. Business officers can answer critical questions immediately, rather than waiting for reports to be finalized.

Real-time insight supports:

- Confident approvals

- Faster course correction

- Fewer year-end surprises

Practical insight:

Ask whether the system shows committed spend, not just posted transactions. Commitments often matter more than expenses when managing budgets mid-year.

Timeliness is not about speed for its own sake—it is about making decisions with full context.

6. Applying Budget Controls That Support Discipline, Not Delay

Budget controls are often seen as obstacles. In reality, the right controls protect both finance teams and operational leaders.

Built-in controls—such as spending validations, approval thresholds, and alerts—help ensure alignment with approved budgets without constant manual oversight.

Practical insight:

Controls should be configurable by budget type and risk level. Not every expense requires the same scrutiny.

When controls are embedded into workflows, discipline becomes part of daily operations instead of an after-the-fact correction.

7. Leveraging Prior-Year Budgets and Actuals for More Informed Planning

Strong budgeting does not begin from scratch.

It begins with context.

Effective school accounting software allows finance teams to review prior-year budgets alongside actual results within the same system. Comparing what was planned with what occurred provides practical guidance when setting current-year allocations.

When historical data is readily accessible, recurring variances, enrollment shifts, staffing costs, and program expenses become easier to evaluate. Decisions are grounded in evidence rather than assumptions.

Practical insight:

When evaluating systems, consider how easily the prior-year budget and actual figures can be accessed during the planning process. If historical data lives in separate spreadsheets, budgeting quickly becomes fragmented.

Using past performances does not mean repeating last year’s numbers. It means building more realistic budgets that strengthen overall budget management.

Budgeting as a Core Element of Financial Stewardship

At its best, school accounting software simplifies budgeting rather than complicating it.

The strongest systems support budgeting as an ongoing discipline — combining structure, flexibility, visibility, and control in a way that aligns with how schools operate. Finance teams spend less time reconciling numbers and more time supporting planning, governance, and leadership decisions.

Bringing It All Together

Effective budget management isn’t about adding more limitations. It’s about improving visibility, strengthening decision-making, and using systems built for the real-world demands of school accounting.

FINACS includes a dedicated budgeting module built specifically for schools. It brings together centralized planning, structured controls, real-time visibility, and flexible budgeting tools designed to support the day-to-day realities of school finance.

If you’re exploring ways to strengthen budget management across your institution, book a consultation to see how FINACS can help reduce manual work, improve visibility, and eliminate the constant uncertainty of not having a reliable, up-to-date view of your numbers.